No, this is not an April Fool’s joke. While the price of your nasi lemak and teh tarik may be slightly more expensive this morning due to the implementation of GST today (April 1st 2015), Honda Malaysia has announced that the company’s Completely Knocked Down (CKD) models namely Jazz, City, Civic, CR-V, Accord and HR-V will reflect a decrease in price, ranging from RM500 up to RM2,500 depending on the model.

Below is the OTR pricing and post-GST pricing which will take effect on 1st April 2015;

| HONDA MODELS | PENINSULAR MALAYSIA | ||

| MODEL | VARIANT | CURRENT OTR (RM) | OTR GST (RM) |

| Jazz | 1.5L S | 72,813.50 | 71,774.80 |

| 1.5L E | 79,813.50 | 78,756.80 | |

| 1.5L V | 87,813.50 | 86,985.70 | |

| City | 1.5L S | 75,813.50 | 74,007.50 |

| 1.5L S+ | 78,813.50 | 77,124.40 | |

| 1.5L E | 83,813.50 | 82,269.50 | |

| 1.5L V | 90,813.50 | 89,467.80 | |

| HR-V | 1.8L S | 99,815.30 | 98,690.40 |

| 1.8L E | 108,815.30 | 108,027.10 | |

| 1.8L V | 118,815.30 | 118,229.10 | |

| Civic | 1.8L S | 113,815.30 | 113,198.70 |

| 2.0L S | 125,815.30 | 124,780.30 | |

| 2.0L Navi | 132,815.30 | 132,210.70 | |

| CR-V | 2.0L 2WD | 139,815.30 | 138,069.70 |

| 2.0L 4WD | 150,815.30 | 149,152.40 | |

| 2.4L 4WD | 169,817.10 | 167,887.80 | |

| Accord | 2.0L VTi | 139,830.60 | 137,301.90 |

| 2.0L VTi-L | 149,830.60 | 148,200.60 | |

| 2.4L VTi-L | 174,834.20 | 173,386.60 | |

| Odyssey | 2.4L EX | 228,023.00 | 229,030.60 |

| 2.4L EXV | 248,023.00 | 248,536.00 | |

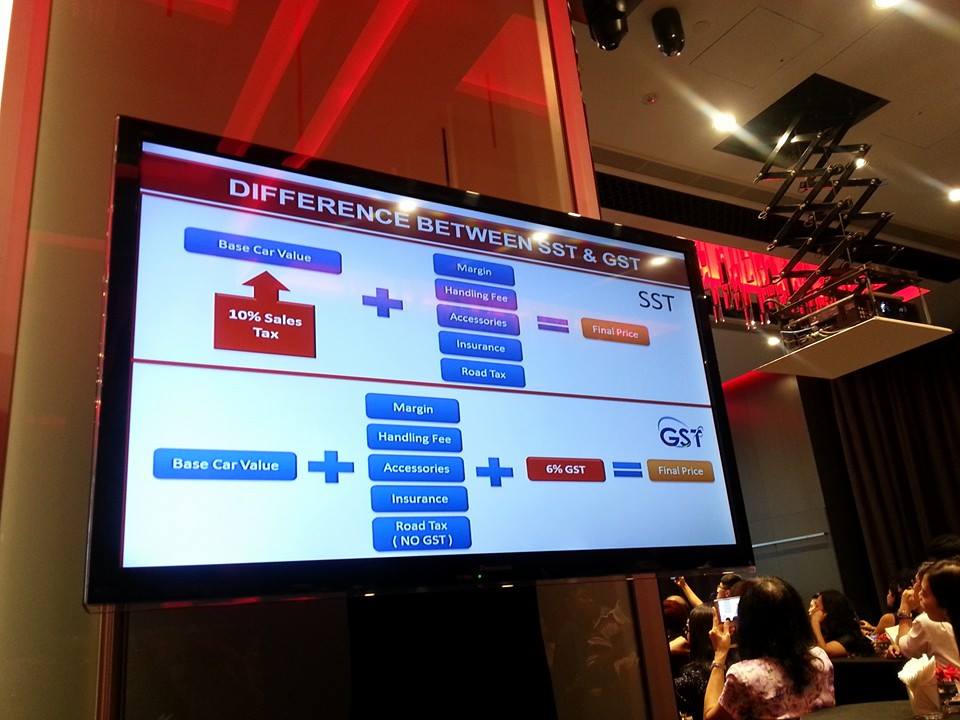

Speaking of GST, many of you are aware that for automobiles, Sales and Service Tax (SST) will be replaced by GST and the change of the car prices would be a little more complicated than other commodities.

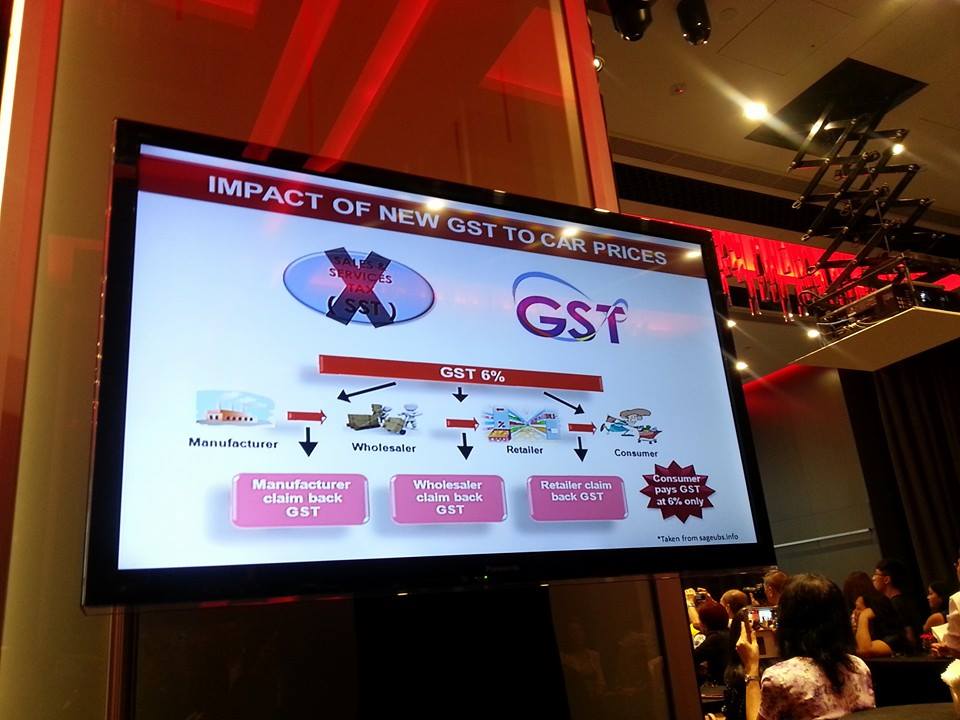

At the media gathering with Honda Malaysia earlier this week, the company explained that the current SST is only applied once at the manufacturer’s level. Meanwhile, GST will be imposed at each level of a supply chain, from a manufacturer up to a consumer. Each level in the supply chain will add 6% GST, but the contributed tax in the former level will be deducted by the entity at the next level.

The main difference in the tax calculation is the taxable base between GST and SST. The Sales tax of 10% tax rate is based on theex-distributor value of the car which does not include dealer margins, transportation cost and handling fees, accessories and other miscellaneous distribution costs, while GST will be charged on the final selling price of the car on the road. Although there is a difference of 4% in the tax rate, the impact to the car price varies due to this difference of the taxable base.

Therefore, for all Honda CKD models, there would be a slight price reduction. The difference in the reduction is due to the difference in features and accessories during the tax calculation. However, for CBU (Completely Built Unit) like the Honda Odyssey, the price will increase slightly from RM500 – RM1,000. For the existing or unsold stock units, the company believes that Honda dealers can claim back the SST which was imposed at the timing of wholesales.

Managing Director and Chief Executive Officer of Honda Malaysia Mr. Yoichiro Ueno said, “In the automotive industry, the difference in the car prices is not as straightforward as 10% minus 6% as there are many factors involved. The main difference in the tax calculation is the difference in the taxable base for SST and GST. For example, the SST was based on the distributors value of the car and is then charged 10% tax excluding dealer margins, transportation cost, handling fee, accessories and other miscellaneous distribution cost while GST is charged based on the final selling price of the car on the road.”

That’s not all, the price of Honda’s spare parts will also be reduced after the implementation of GST. “The price of our spare parts will also be reduced by an average of 3.7% across all models. GST will be added to the labour charge. However, due to the reduction of the spare parts price, we estimate that the total maintenance cost will be reduced by 2% – 4% depending on the model,” said Mr. Ueno.

With the strong economy in Malaysia and hopefully a stable market after the GST introduction, Honda is confident that the company will be able to achieve its 2015 sales target of 85,000 units and make an impact in the future growth of Honda in Malaysia.