Customer satisfaction with the new-vehicle shopping process is increasing in Malaysia, providing a positive counterpoint in an auto industry weakened by a sluggish economy, vehicle price hikes and GST implementation, according to recent J.D. Power 2016 Malaysia Sales Satisfaction Index (SSI) Study.

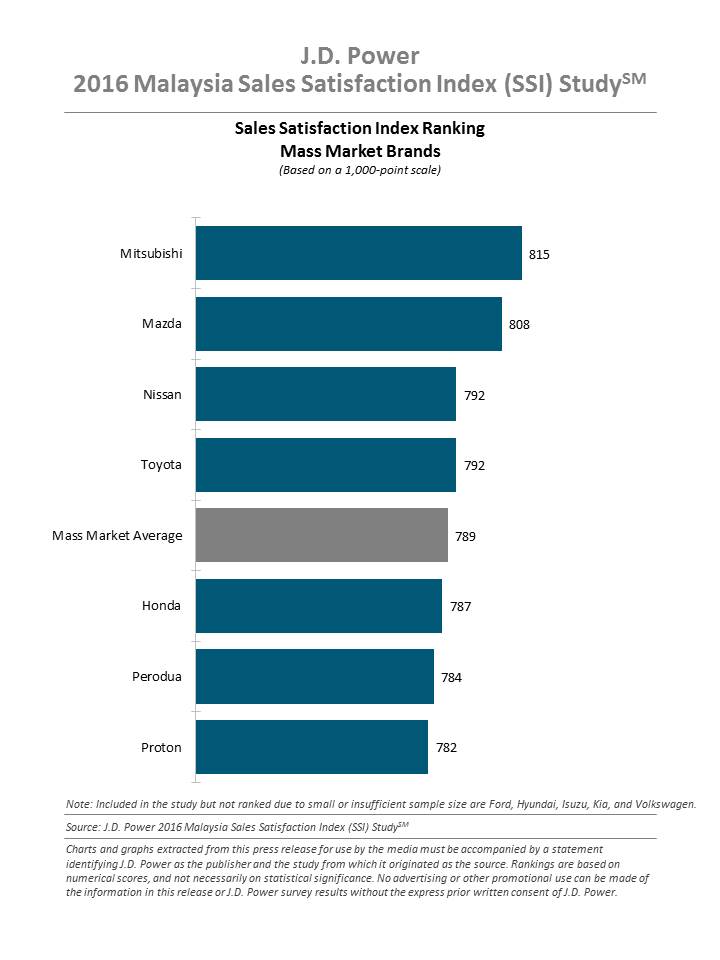

Now in its 14th year, the study examines sales satisfaction in the mass market segment across 6 factors that contribute to overall customer satisfaction with the new-vehicle purchase experience (in order of importance): salesperson; dealer facility; delivery timing; deal; delivery process; and sales initiation. Sales satisfaction is calculated on a 1,000-point scale.

Facing declining sales volume, the automotive industry has been focused on driving improvements in the sales experience in an effort to woo customers who are currently hesitant to make big-ticket purchases. The overall sales satisfaction score of 789 (on a 1,000-point scale) in 2016 is a significant improvement of 37 points from last year.

Newly launched models—those launched from August 2015 to May 2016—contribute to the rise in satisfaction compared with existing models (804 vs. 787, respectively). Additionally, new-model buyers have a more satisfying shopping experience, as the incidence of salespeople offering a test drive (73%), demonstrating features during test drives (54%) and contacting customers to ensure everything was satisfactory (66%) are higher, compared with existing-model buyers.

“The excitement that surrounds a new model launch has the ability to draw customers into the showrooms,” said Mohit Arora, regional vice president at J.D. Power. “Car dealers that fully capitalize on their customers’ heightened interest with an energizing shopping experience can gain from highly satisfied customers who are more likely to repurchase and recommend.”

The study finds fewer incidences of problems experienced by customers during the shopping process. 9 out of 10 customers indicate having a problem-free experience, which is a great improvement from last year. Furthermore, salespeople are more focused on providing comprehensive explanations on features and benefits and thorough explanations during delivery.

“The tremendous effort in providing customers with an issue-free sales experience will pay off on building long-term customer relationships,” said Rajaswaran Tharmalingam, country head of Malaysia at J.D. Power. “When the market picks up, their efforts will be rewarded with an increase in sales volume and customer loyalty.

Below are additional findings of the 2016 study

- Narrowing Gap between Domestic and International Brands: Overall satisfaction with domestic brands has increased to 783 in 2016 from 736 in 2015, closing the gap with international brands to 11 points this year from 34 points last year.

- Average Delivery Times Shorten: The average delivery time is 17.0 days, which is faster than the 21.8 days in 2015. When a car is delivered within 14 days, overall satisfaction is higher than it is among those whose delivery time is 15 or more days (802 vs. 772, respectively).

- Satisfaction Increases Loyalty and Advocacy: Among highly satisfied customers (SSI scores of 864 and above), 46% say they “definitely would” recommend the brand to family and friends. In contrast, among customers who are highly dissatisfied (SSI scores of 713 and below), only 20% say they “definitely would” recommend the brand to others.

Among the 7 brands ranked in the study, Mitsubishi ranks highest in new-vehicle sales satisfaction with a score of 815. Mitsubishi performs particularly well in sales initiation, dealer facility, salesperson, delivery timing and delivery process. Mazda ranks second with a score of 808 and performs particularly well in the deal factor. Nissan and Toyota tie for third at 792.

The 2016 Malaysia Sales Satisfaction Index (SSI) Study is based on responses from 2,010 new-vehicle owners who purchased their vehicles from August 2015 through May 2016. The study was fielded from February through July 2016.