With the proposed Government Service Tax (GST) coming into effect in less than a week’s time, many questions have been raised. For this article, we will look into how GST will be affecting insurance policies.

The first question that is on everyone’s mind is whether all general insurance policies subject to GST? In short, yes. All insurance policies issued are subjected to the 6% GST, unless the risk is outside of Malaysia, like Travel Personal Accident and Marine policies.

Next up, those wondering if their policy is subjected to the 6% GST and will GST affect the cost of insurance policies, the answer is also yes. Anyone who has a valid insurance policy at the moment are subject to GST and the cost of insurance policies will increase if you’re a non-registered GST person. However for a registered GST person, you can claim Input Tax Credit on the GST you paid from the Royal Malaysian Customs Department (RMCD).

After that, one may be wondering how will they be billed for the GST on his premium? The insurance company will issue the policyholder (you) a tax invoice for the amount of premium to be charged and the appropriate GST on the premium.

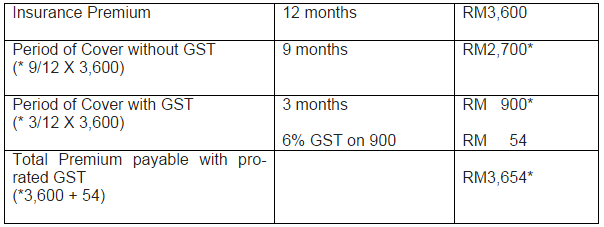

For those curious about the calculations of insurance premium, the answer is that it will be calculated pro-rate. Here is the calculation of pro-rated GST/premium.

If the policyholder is wondering if they can exempted from GST even though their policy is after 1st April 2015 by renewing before next month, the answer is no. The insurance company may collect the GST amount from the policy holder on or after 1st April 2015. By law, every consumer has to pay GST.

What about claims then? For those who are GST-registered and entitled to claim Input Tax Credit, the insurance company will exclude GST from the claim amount paid to the policyholder. But for those who are not GST-registered, the insurance company will pay the claim in full (including GST) up to the sum insured/limit of liability or other limits of insurance cover.